iPhone 15 Tops the Table for Value Retention, Depreciating 27.1% Less than other Flagship Handsets….but Samsung S23 is the undisputed champion in Android camp.

- iPhone 15 Pro Max 256GB is the leader when it comes to value retention, with only 18.2% value lost in the three months following its launch (for a device in mint condition).

- Ahead of the S24 launch, Samsung S23 models are the undisputed Android value champions, depreciating up to 32.8% less than other new Android devices.

- Samsung’s Galaxy S23 Plus 256GB handset is also doing well in terms of value retention. 3 months post-launch sees only 35.3% of its value lost (for a device in mint condition).

2023 saw a wide range of new flagship phones hitting the market. With the iPhone 15, Samsung Galaxy S23, Pixel 8, and OnePlus 11 Pro ranges all coming to stores last year, smartphone customers are spoilt for choice when it comes to selecting a new handset. All of these brands hailed their new device as a revolution in smartphones, with prices ranging from $629.99 to $1,619.99.

A key indicator of a smartphone’s appeal is the resale value of the device, and how much value the device has lost when the resale value is compared to the original MSRP. This helps a customer determine if the device is a good investment and if it is worth buying if they intend to sell it on at a later date.

With this in mind, SellCell has collected smartphone depreciation data from its pool of over 40 buyback vendors, to look at previous trends and offer insight into how the various smartphones perform in the three-month window post-launch. The article will compare smartphones from Apple, Samsung, Google, and OnePlus, to see which performs best for smartphone value depreciation (i.e. which loses least value) and which performs the worst (i.e. which loses most value). Let’s look at the stats…

SellCell Key Findings

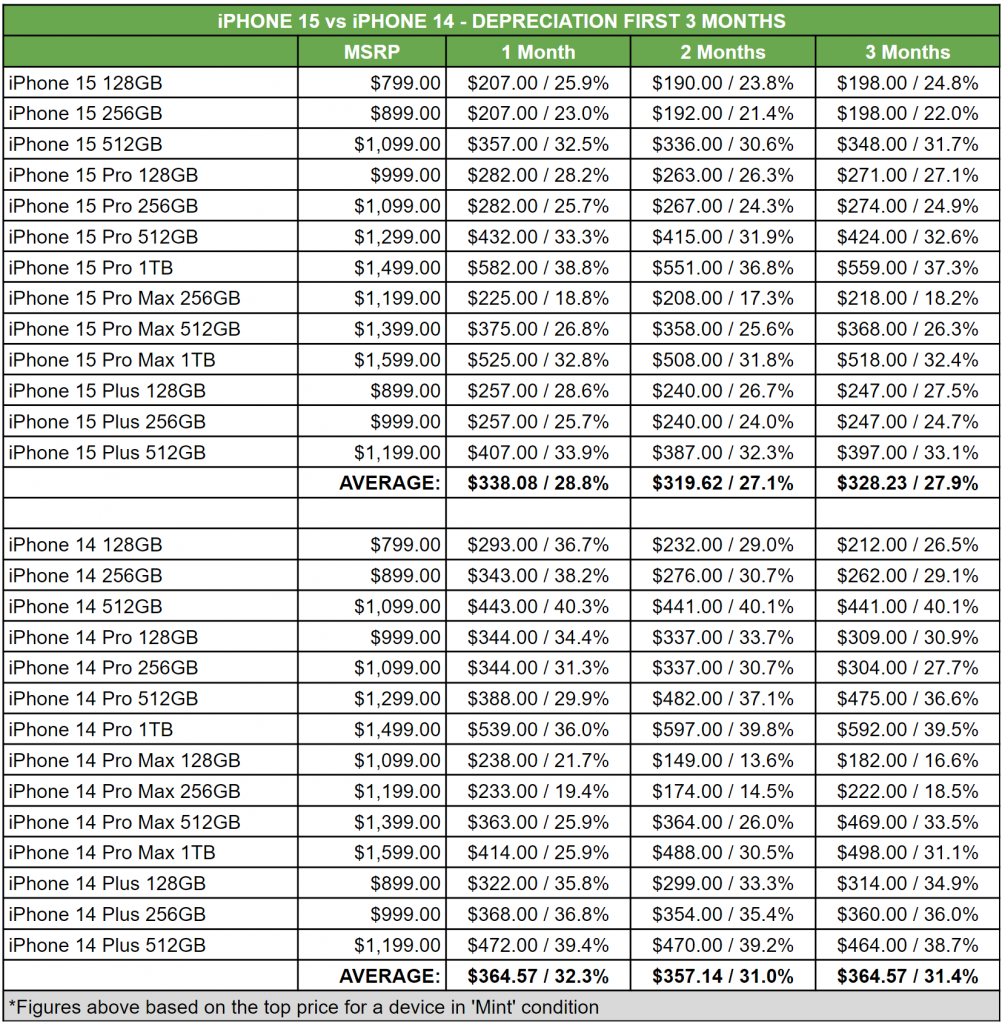

- The iPhone 15 range is outperforming the iPhone 14 range, on average, by 5% over the first three months since launch. The iPhone 15 Plus 256GB is leading the way, depreciating 11% less than its iPhone 14 predecessor.

- iPhone 15 range is outperforming the other newly (2023) launched handsets from a resale perspective. Within an initial three month window since launch, on average, it retains 27.1% more value than other brands.

- Samsung’s Galaxy S23 Plus 256GB has made it to the ‘Top 15 Best Value Retaining Phones’ with depreciation at an excellent 35.3% placing it ahead of the iPhone 15 Pro 1TB. But overall Samsung’s S23 series still underperforms vs. the iPhone 15 Range

- ….however, from all Android smartphones analysed, Samsung S23 Flagship range wins hands down, depreciating 16.7% less than the Pixel 8 range, and 4.0% less than the OnePlus 11 Pro series.

- The iPhone 15 Pro Max 256GB has retained almost double (1.9 times) the value of the Samsung Galaxy S23 Plus 256GB. In the three months following launch, the Pro Max 256GB lost 18.2% of its value ($218.00) versus the S23 Plus 256GB, which lost 35.3% ($352.99) of its value.

- The S23 performed better in the three months post-launch than the Samsung Galaxy S22 series did in 2022.

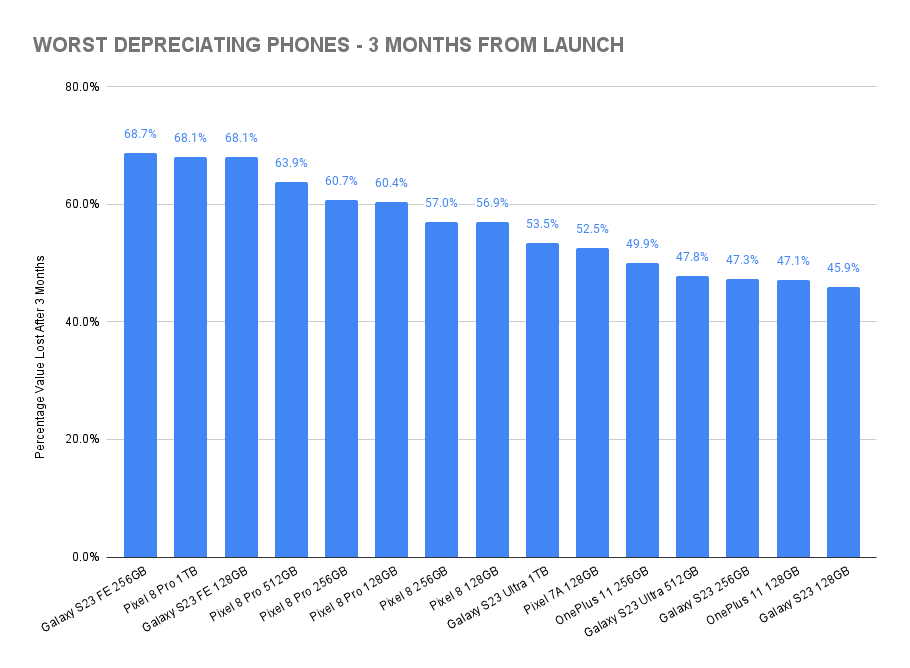

- The worst performing handset across multiple brands is the Samsung Galaxy S23 FE. In the three months following its 2023 launch, it lost a massive 68.7% of its value. The S23 FE range (which comprises two models), lost 68.4% of its value on average.

- Google’s Pixel 8-series of smartphones didn’t do much better than the S23 FE range. This series lost 61.2% of its value overall, in three months following launch.

Summary

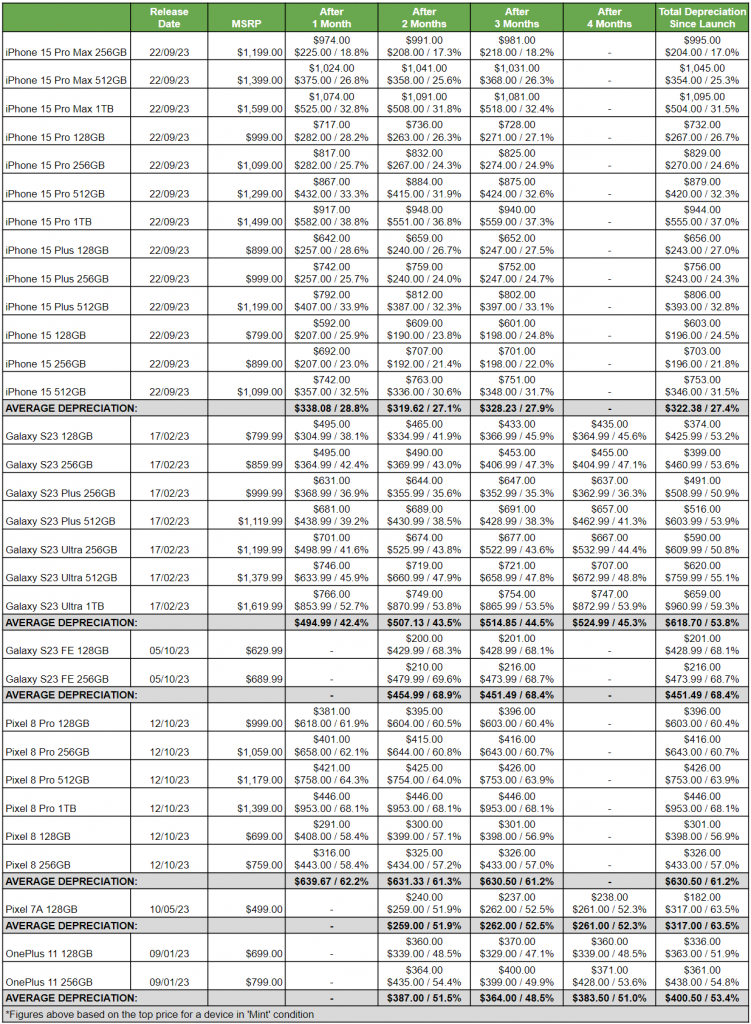

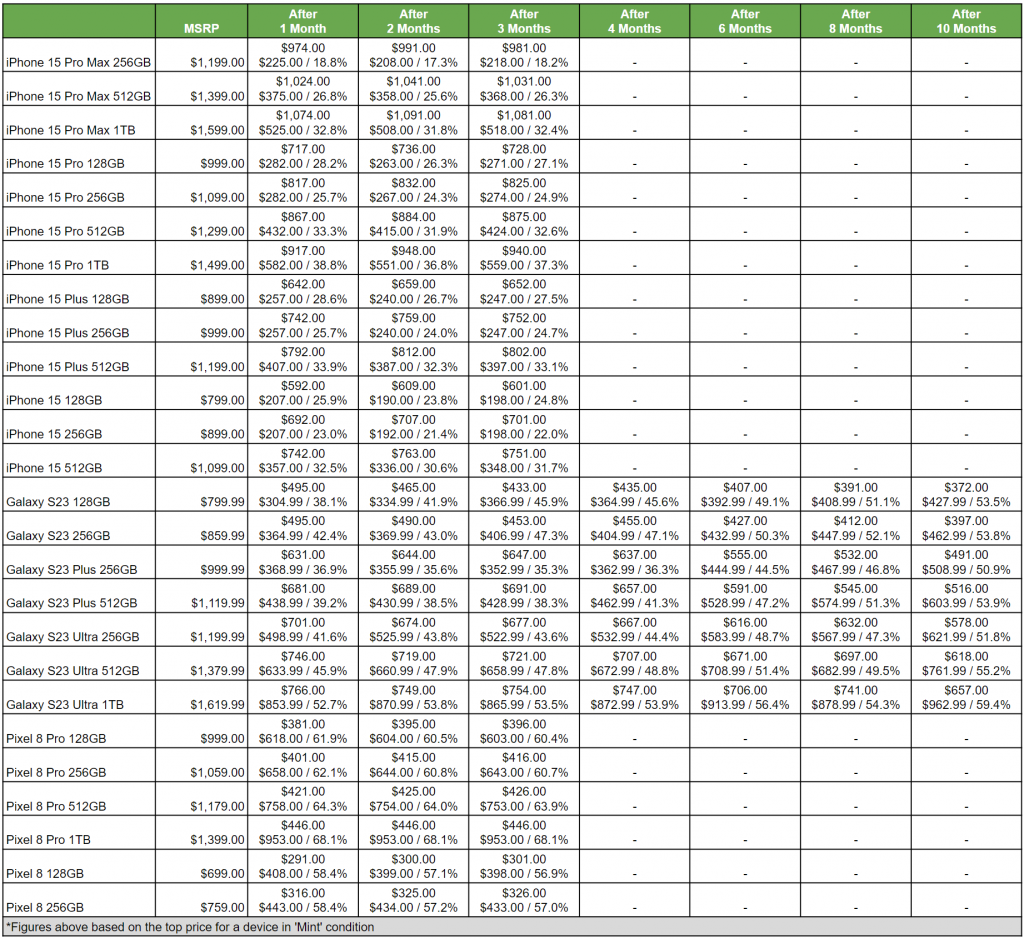

The following data shows the depreciation values of smartphones for Apple, Samsung, Google, and OnePlus.

Overall Smartphone Value Depreciation Data

- As we can see from the data table above, iPhone (as usual) leads the charge when it comes to value retention. After one month, the range had lost only 28.8% of its value on average. By the end of month two, this was 27.1%; lower than month one, meaning it regained some value. In month three, depreciation rose again to 27.9% against the MSRP. At the time of writing, it had regained a small percentage back again, with 27.4% depreciation.

- The non-FE Galaxy S23 models are doing better than the S22 did in the same time frame. The range had lost 42.4% of its value by the end of month one. At the end of month two, depreciation was at 43.5% on average. By month three, we see a 44.5% value loss.

- For the Samsung Galaxy S23 FE series, depreciation is higher than the non-FE handsets. By the end of month two, the range lost an average of 68.9% of its value. However, month three sees the handset regaining a little value, with depreciation at 68.4% of its MSRP, so a value reclamation of 0.5% against the MSRP.

- Despite regaining a small percentage of their value overall, the picture isn’t great for the Google Pixel 8 range of handsets. At the end of month one, it had lost an average of 62.2% of the MSRP. Month two saw a very slight increase in value, with depreciation at 61.3%. Month three saw depreciation of the Pixel 8 range reduce again by 0.1%, as it had lost 61.2% of its value against the original MSRP.

- The Pixel 8 is performing worse after 3 months compared to the Pixel 7A. The 7A had lost 51.9% of its value in month two, and 52.5% of its value by the end of month three.

- OnePlus is somewhat of a dark horse when it comes to value retention. It is actually performing better with its 11-series than Google is with the Pixel 8 series. After two months, we see a depreciation value of 51.5%. In month three, it showed a respectful 3.0% value recovery, with depreciation at 48.5%.

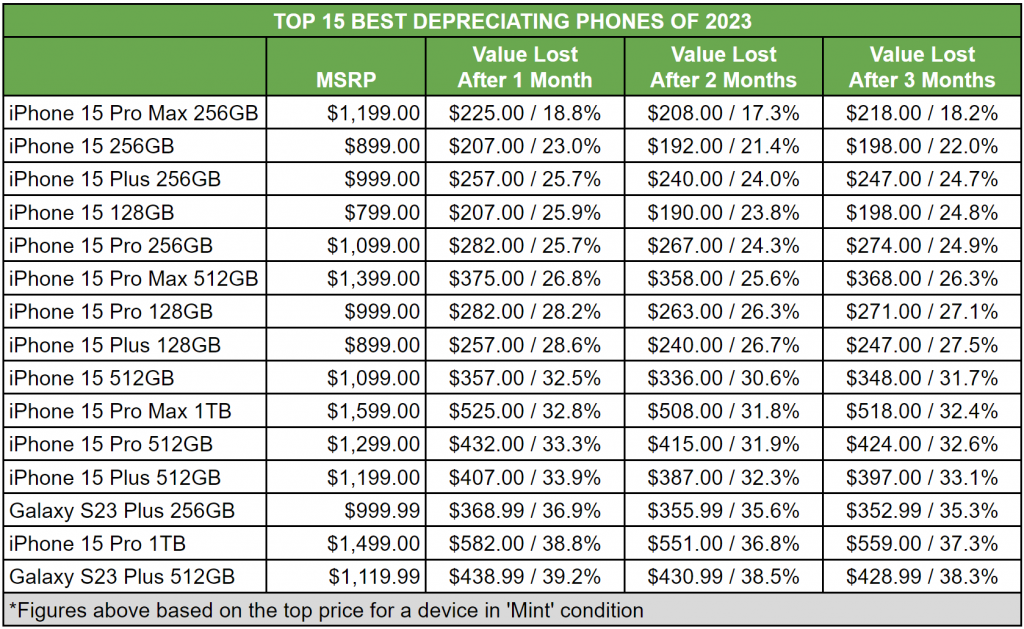

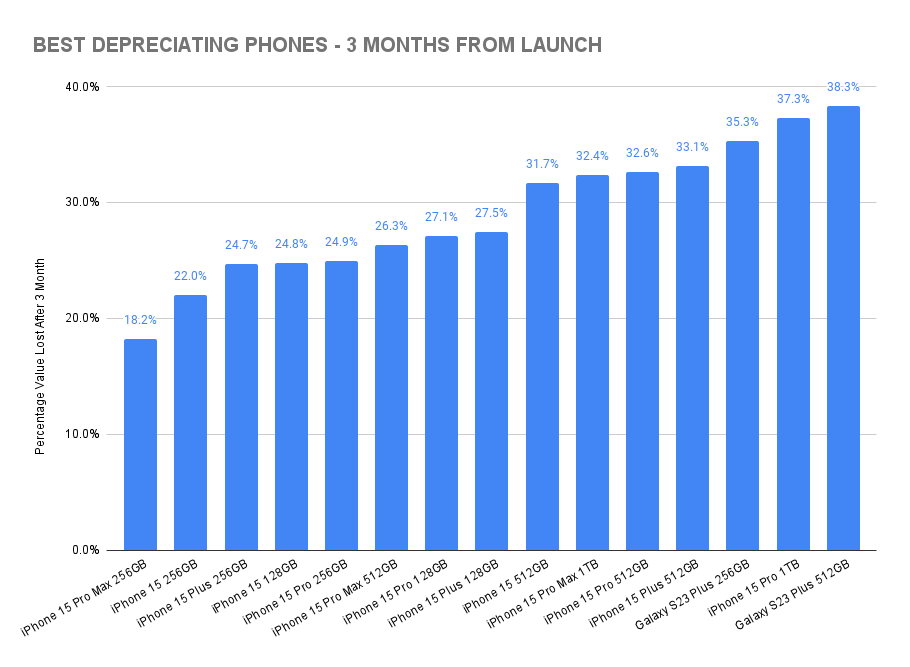

Smartphone Value Depreciation: Top 15 Most Value Retaining Smartphones

- The smartphone with the best value retention is, by far, the iPhone 15 Pro Max 256GB. It lost 18.8% of its value after one month, regained value to 17.3% depreciation in month two, and then lost value again in month three when depreciation hit 18.2%.

- Two of Samsung’s S23 handsets have made the top 15. The best performing Galaxy S23 for value retention is the S23 Plus 256GB. This has regained lost value since launch, which is excellent form. After one month, it had lost 36.9% of its MSRP. After month two this was 35.6%. By the end of month three, it had regained a further 0.3% of its lost value, with depreciation at 35.3%.

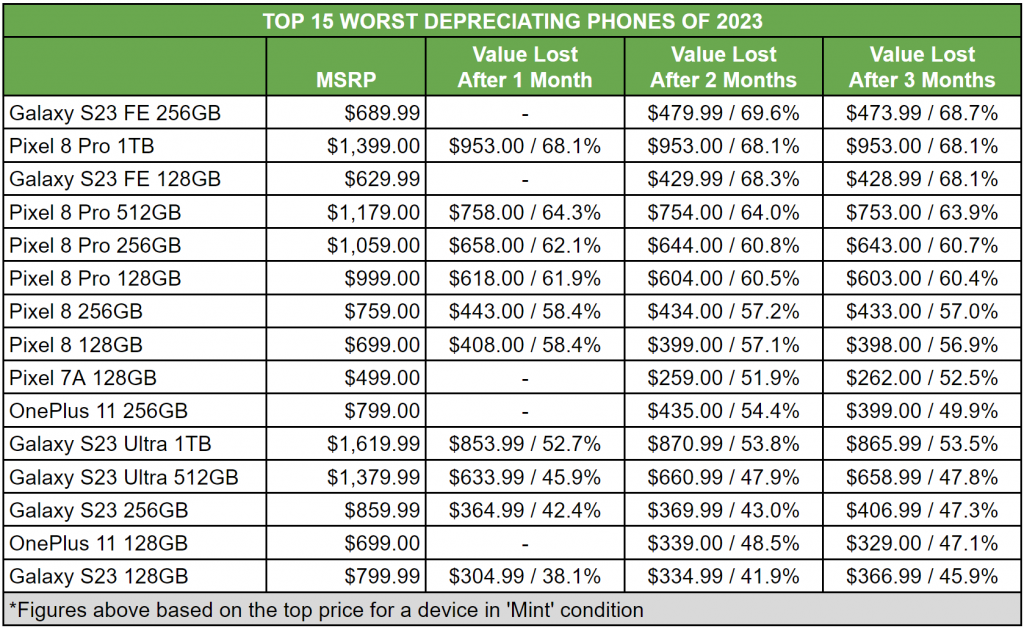

Smartphone Value Depreciation: Top 15 Least Value Retaining Smartphones

- Samsung’s mid-range S23 offerings—the FE-series—has not performed well in terms of value retention. By month two, the 256GB variant had lost 69.6% of its value. However, it clawed some value back in month three, when depreciation was 68.7%.

- Every Google Pixel phone performed badly in the three months following release. The worst performer is the flagship Pixel 8 Pro 1TB, which lost 68.1% of its value in month one. However, it did not lose any further value in months two and three.

- Despite being in the top 15 least value retaining smartphones of 2023, the OnePlus 11 range is not actually faring badly compared to others on the list. The 128GB variant is the best performer, losing only 48.5% of its value by the end of month two, and actually regaining 1.4% of its value by the end of month three, when depreciation was at 47.1%.

Smartphone Value Depreciation: iPhone 15 vs. iPhone 14

- The table above compares iPhone 15 models with their iPhone 14 alternatives. The iPhone 15 Plus 256GB depreciated 11.3% less than its iPhone 14 equivalent.

- Apple’s iPhone 15 range depreciated up to 11% less than the iPhone 14 across all models.

- The iPhone 15 range, on average, is depreciating 5% less than iPhone 14 did in the three months following the launch.

Smartphone Value Depreciation: Samsung Galaxy S23 Range

- Samsung released the Galaxy S23 range in February 2023, so there is more depreciation data available for this series.

- The best performing S23 model is the S23 Plus 256GB. By month four, it had still only lost 36.3% of its overall value. By month 10, this figure stands at a respectable 50.9% value loss against the $999.99 MSRP.

- The flagship S23 Ultra 1TB has lost the most value after 10 months, dropping 59.4% of its launch value.

- It is worth noting Samsung offered a discount when it launched the S22, which had an immediate effect on resale value. With the S23, customers were given a discount if they traded in their old phone.

Samsung is the ‘Value Retention Winner’ Amongst Androids

Whilst the iPhone 15—and Apple generally—produce smartphones that hold the best value overall, Samsung is doing a great job of topping the list in the Android category. The S23 Flagship range not only appeared in the Top 15 best value retaining phones for 2023, but also depreciates less than other Android smartphones. This is with the exception of the FE budget range.

As the smartphone value depreciation data shows, ignoring anything Apple-related, we can see that the Samsung Galaxy S23 range is the best for retaining value for Android devices. So, Android fans, if you’re out for a new smartphone especially with the S24 range on the horizon, make it Samsung if you want it to hold its value better than any other Android handset out there.

iPhone Reigns Supreme. Again.

The iPhone has historically been the best smartphone available in terms of value retention. The iPhone 15 range is proving no different and, in fact, is outperforming the iPhone 14. It is depreciating at a slower rate than the iPhone 14 did, which is great news for iPhone 15 owners.

It remains for us to see whether the Samsung S24 series—launched at the 2024 Samsung Unpacked event—will outperform the S23 range. However, Samsung still needs to catch up with iPhone where value depreciation is concerned.

Methodology

SellCell analysed internal sales data for iPhone 15, Samsung Galaxy S23, OnePlus 11, and Google Pixel 8 smartphone ranges across 40 buyers, considering the trade-in value of all models from each respective range, in “mint” condition, to determine the value depreciation of the handsets in months 1-3 since launch. It also compared this data to that for the Samsung Galaxy S22, Google Pixel 7, and iPhone 14, to see whether any patterns existed. Prices are taken from tech buyers that offer a cash resale value for the phone, without tying them into buying/ leasing a new device.

Our content is created in good faith and reviewed regularly - if you spot an error, please contact corrections@sellcell.com. Read our Editorial Policy