PSA: iPhones continue to hold their value vs. other brands… But watch out, as Samsung Galaxy S-series retains more value with each new release.

iPhone depreciation has always worked in the favor of iPhone users, since these devices typically hold their value well. But with the recent launch of the iPhone 16, what is depreciation looking like now? Is Apple still leading the pack when it comes to making phones that depreciate slower than competitors?

- iPhones are still the champs at keeping their value, but new data reveals they’re depreciating faster with each new release, while Samsung’s top models hold up better.

- Since the iPhone 12, Apple has seen almost a 5% drop in value year-over-year across its models.

- In just two weeks after its launch, the iPhone 16 is losing value 8% quicker than the iPhone 15 did.

The value of the iPhone remains high, but be aware that Samsung is losing less value with each new Galaxy S release. This means that while iPhones still hold their worth well, Samsung phones are not dropping in value as much as they used to when a new model launches.

Report Objective

Apple has long been regarded as the ultimate manufacturer of innovative iPhones which hold their value better than other smartphones. But as all manufacturers ramp up investment in new technologies, including AI, is Apple doing enough to ensure that their iPhones are still the very best investment for users.

This report will help you find out the following:

- Whether Apple is still the frontrunner in terms of smartphone value retention.

- If iPhones are holding as much value every year vs the Samsung S Series.

- How the iPhone 16 value retention is holding up a few weeks after launch vs iPhone 15.

Main Findings

- iPhones maintain strong resale value, but data shows they are losing value more quickly with each new model, while Samsung’s S Series perform better YOY with each release

- Since the iPhone 12, Apple has experienced nearly a 5% annual decline in value across its lineup.

- The iPhone 16 is depreciating 8% faster than the iPhone 15 just two weeks post-launch

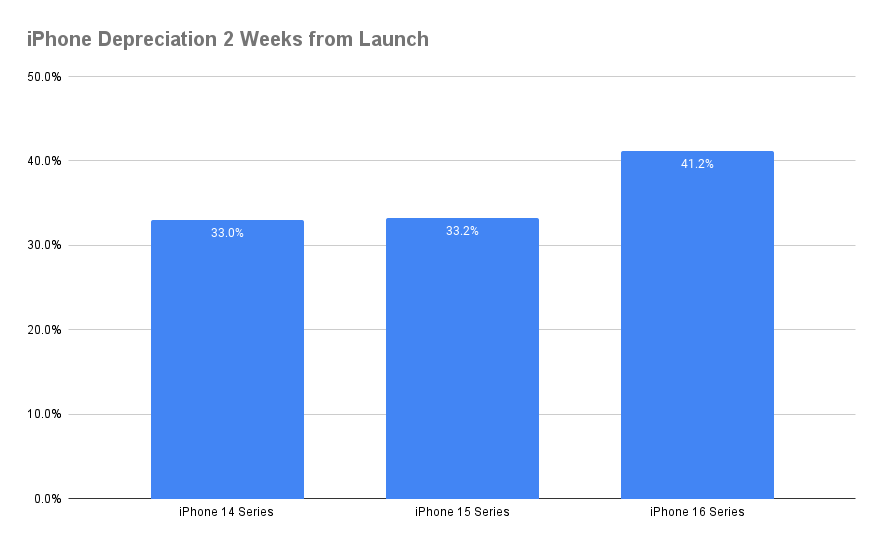

- In the first two weeks since launch, the iPhone 16 is showing worse value retention than the iPhone 14 and 15 models that preceded it. The 16-series has lost an average of 41.2% of its value across the range.

- The iPhone 14 lost 33.0% of its value in the first two weeks post launch, and the iPhone 15 lost 33.2% of its value against the original MSRP.

- Over 12 months, we can see that year-on-year the iPhone’s value retention is gradually eroding, while Samsung’s handsets are improving in this space, retaining more value over 12 months YOY. The iPhone 13 had lost 46.2% of its value after 12 months, whereas the iPhone 15 had lost 48.2%.

- By comparison, the S22 lost 66.7% of its value in 2022, while the S23 lost 61.1% of its value in 12 months. This is an improvement of 5.6% value retention post launch, year-on-year

Report Summary

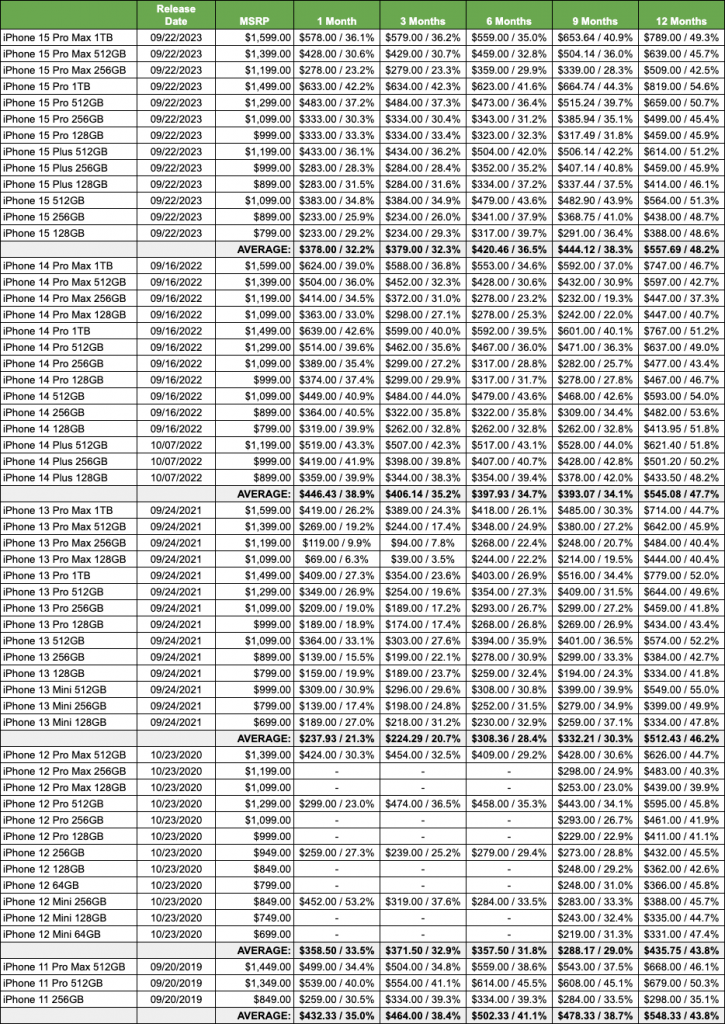

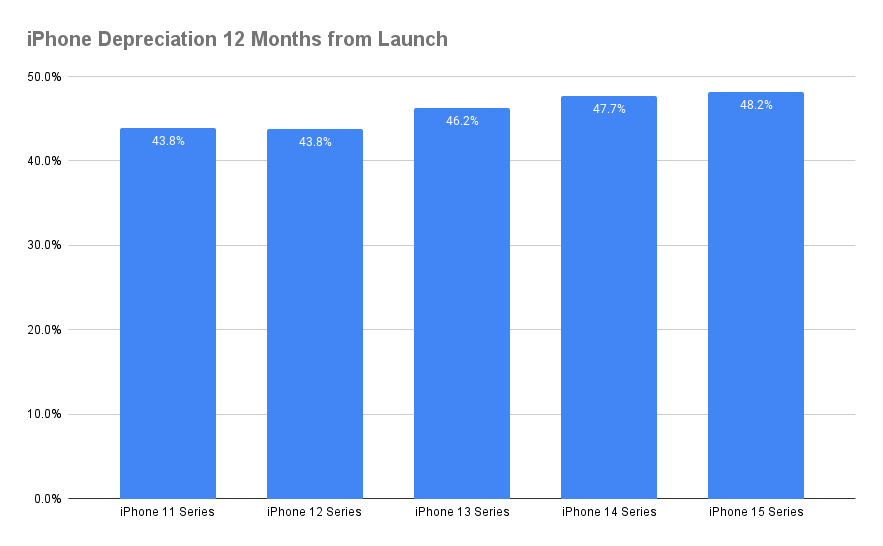

iPhone Range Comparison – 12 Month Post Launch

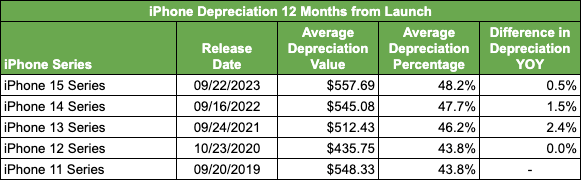

iPhones Are Losing More Value With Each New Range

After 12 months, iPhones are losing value compared to the previous release. It might still be the king compared to other brands but, compared to its own previous models, its value retention gets slightly less impressive each year.

- In the twelve months following launch, the iPhone 11 lost 43.8% of its value on average, across the entire series. Comparatively, in the same time period, the iPhone 12 lost the same amount.

- The iPhone 13 lost 46.2% of its value after 12 months. This is a 2.4% increase in depreciation compared to the iPhone 12. The iPhone 14 lost 47.7%, 1.5% more than the 13-series. The iPhone 15 comparatively lost 48.2%, a 0.5% increase on the 14.

So, it seems that depreciation is marginally speeding up on the iPhone.

Will the AI features of the iPhone 16 be enough to turn this around, and reduce that 48.2% depreciation exhibited by the iPhone 15? Or will the depreciation rate increase more? Let’s see some very early iPhone 16 data compared to the same period the year before.

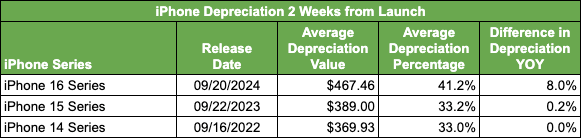

iPhone 16 Range Comparison – 2 Weeks Post Launch

iPhone 16 Depreciation Reached An All Time YOY High

Apple’s latest handset might only be a few weeks old, but we already have data relating to value retention for the 16-series.

- In 2022, the iPhone 14 series had lost 33.0% of its value in the two weeks following its launch.

- The iPhone 15 lost 33.2% of its value in that same timeframe, a difference of 0.2% on the previous year.

- After two weeks, the iPhone 16 has lost 41.2% of its value; a marked difference of 8.0% compared to the iPhone 15 in the same two-week period. The difference between the 16-series and 14-series is 8.2%.

So, over a two week period after launch, the iPhone has performed worse in terms of value retention, year-on-year. You can see the prices to sell an iPhone 16 already.

This, however, doesn’t mean the 16-Series won’t recover. If demand for the iPhone 16 spikes, then post-sale depreciation could slow, or even reverse. Time will tell.

Samsung Galaxy S23 Comparison – 12 Months Post Launch

Samsung’s Year-on-Year Depreciation is Slowing Down

Samsung is probably Apple’s biggest competitor when it comes to smartphones. At least, it is in the USA. And it appears to be closing the gap on Apple in terms of value retention.

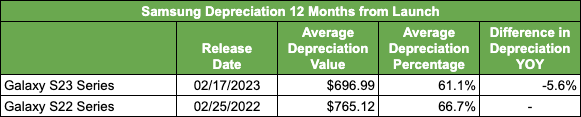

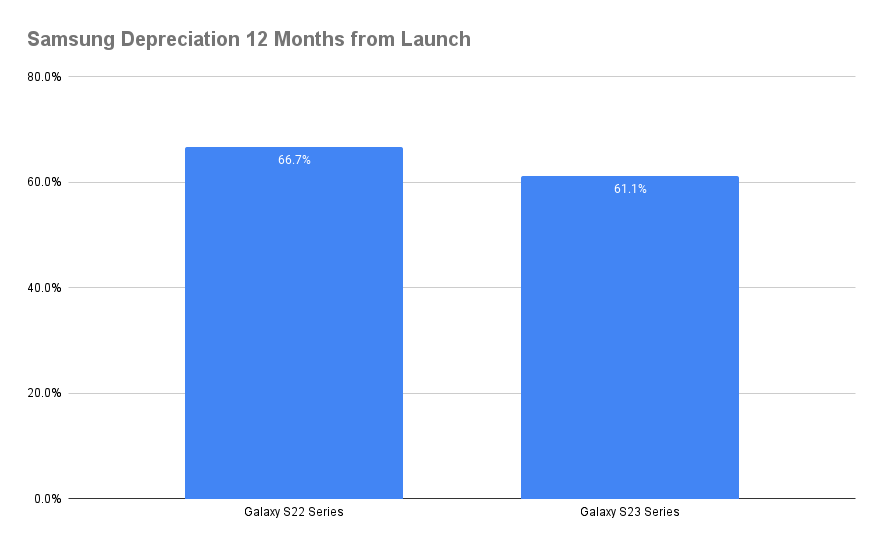

- The Samsung Galaxy S22 series of handsets encountered an average depreciation of 66.7% across the range, in the twelve months after it launched.

- In the same timeframe, the S23—released the following year—only depreciated by 61.1% in comparison. This is a 5.6% improvement on the year before.

So, while Samsung still isn’t the best brand for value retention, it is getting better. It is closing the gap on the iPhone, which should be a real cause for concern for Apple.

If this trend continues, with Apple’s handsets depreciating more while Samsung’s depreciate less, it could be only a matter of three to four years before Samsung finally passes Apple. This is particularly the case if we apply that 5.6% reduction in depreciation year-on-year and forecast it for the next five years.

What of the S24, though…?

Samsung S24 Depreciation Comparison

The S24 Is Performing Better After Six Months Than the S22 and S23

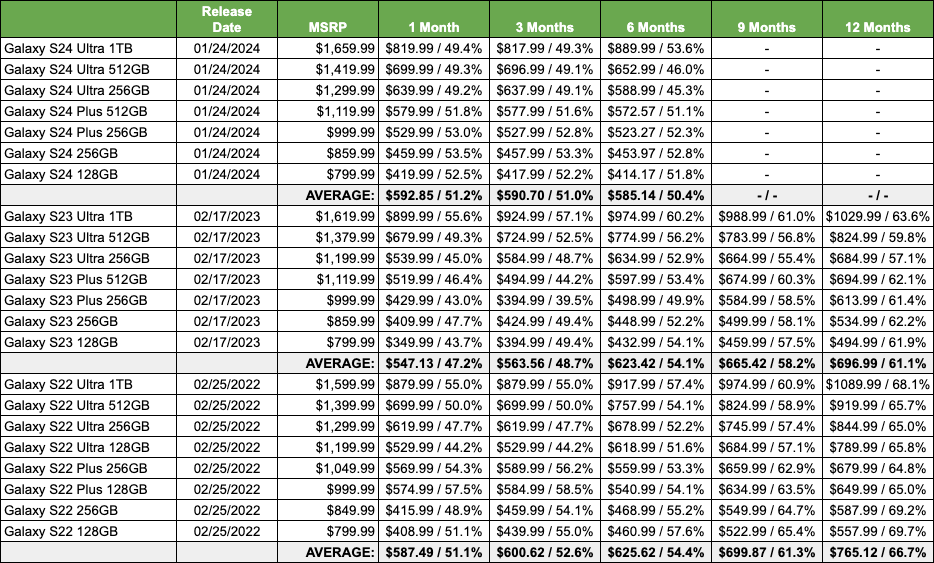

The Samsung Galaxy S24 only arrived in January 2024, so SellCell doesn’t have a full 12 months of data to analyse. However, at the six month point, things are looking good for the S24…

- Looking at the data table above, we can see how much of an improvement the S24 has made compared to the S23, in the six months following launch.

- The S22 showed six-month depreciation of 54.4% following its launch in 2022.

- The S23 reduced that depreciation figure to 54.1%. This might only be a difference of 0.3%, but it is an improvement nonetheless.

- The S24 is doing very well in comparison. Six months post-launch, it is only seeing 50.4% depreciation; an improvement of 3.7% compared to the S23.

With the above points in mind, we can see how the S24 could—potentially—close the gap further on Apple’s iPhone in terms of depreciation. We may even see an improvement on that 5.6% depreciation reduction when comparing the S22 and S23 over 12 months. Should Apple be concerned?

Is the Apple Pie Becoming a Little Stale?

Despite Apple’s long-standing reputation for leading the market in value retention, the gap is narrowing. Samsung’s Galaxy series, particularly with the release of the S24, has started to close in on Apple’s dominance. The S24 has shown stronger value retention after six months compared to its predecessors, the S23 and S22, marking a notable improvement in Samsung’s depreciation performance.

Meanwhile, Apple’s ability to hold value has seen some erosion, with depreciation becoming more pronounced in the 12 months following an iPhone’s launch. Early data for the iPhone 16 suggests it’s not retaining value as well as earlier models, signaling a potential shift in the balance of power in smartphone value retention. While Apple remains the leader, the margin is shrinking, and the competition is closing in.

Methodology

SellCell analyzed trade-in values of iPhones from 11-series to 16-series, with value data for taken from over 40 trusted buyback vendors. SellCell then compared this data to ascertain whether the iPhone remains the market leader for value retention. SellCell also compared iPhone data with that of the Samsung Galaxy S22, S23, and S24, to discover whether Samsung is closing the gap on Apple for value retention.